ID Management: Eine ID für alles

Mit dem Identity Management bieten wir Ihnen eine professionelle webbasierte Software zur Identifikation, mit der Sie neue Nutzer im System anmelden und deren persönliche Daten eingeben und verwalten können. Jeder ID und damit jedem Nutzer wird eine persönliche Chipkarte, eine App mit eigenem Account und ein persönliches Guthabenkonto zugeordnet.

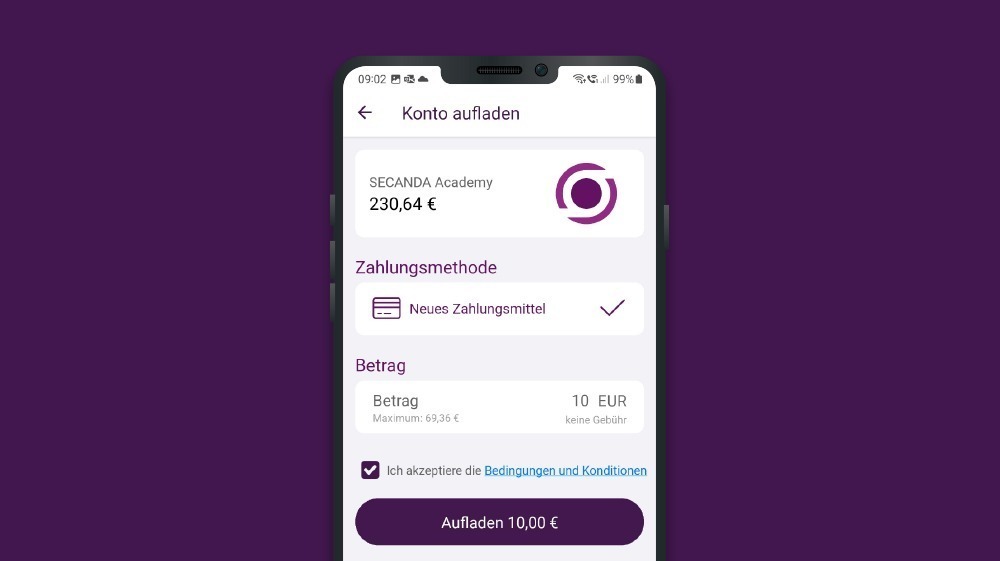

So können sich Nutzer im ganzen SECANDA System an allen angeschlossenen Terminals und Geräten identifizieren und mit der Chipkarte bezahlen. Über die zugeordnete App verwalten sie das persönliche Guthabenkonto. Sie überprüfen ihre Transaktionen, laden das Guthaben auf oder überweisen Geld an andere Nutzer.

Nur einmal registrieren und mit einer einzigen ID das ganze System nutzen

Nutzer nur einmal registrieren oder aus dem ERP-System einspielen

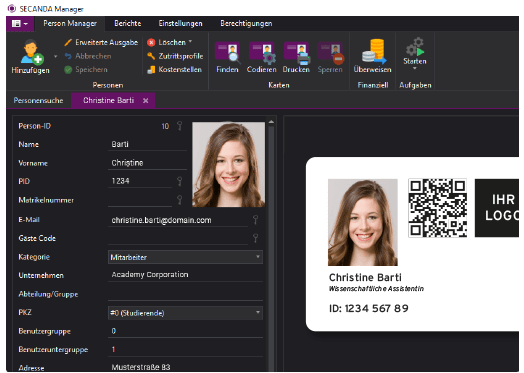

Als Administrator legen Sie in der SECANDA Manager-Software neue Nutzer sekundenschnell an und vergeben eine einzige ID für diese Person. Personen müssen dabei nicht unbedingt neu eingegeben werden, sie lassen sich auch aus ERP- oder Lohn- und Gehaltprogrammen einspielen.

Guthabenkonto anlegen und individuelle Rechte erteilen

In der gleichen Software legen Sie für die zentrale ID ein Guthabenkonto an, von dem Ihre Nutzer an allen Terminals des Systems bezahlen können. Individuelle Rechte für Zutritt oder zu Daten vergeben oder entziehen Sie mit einem Klick.

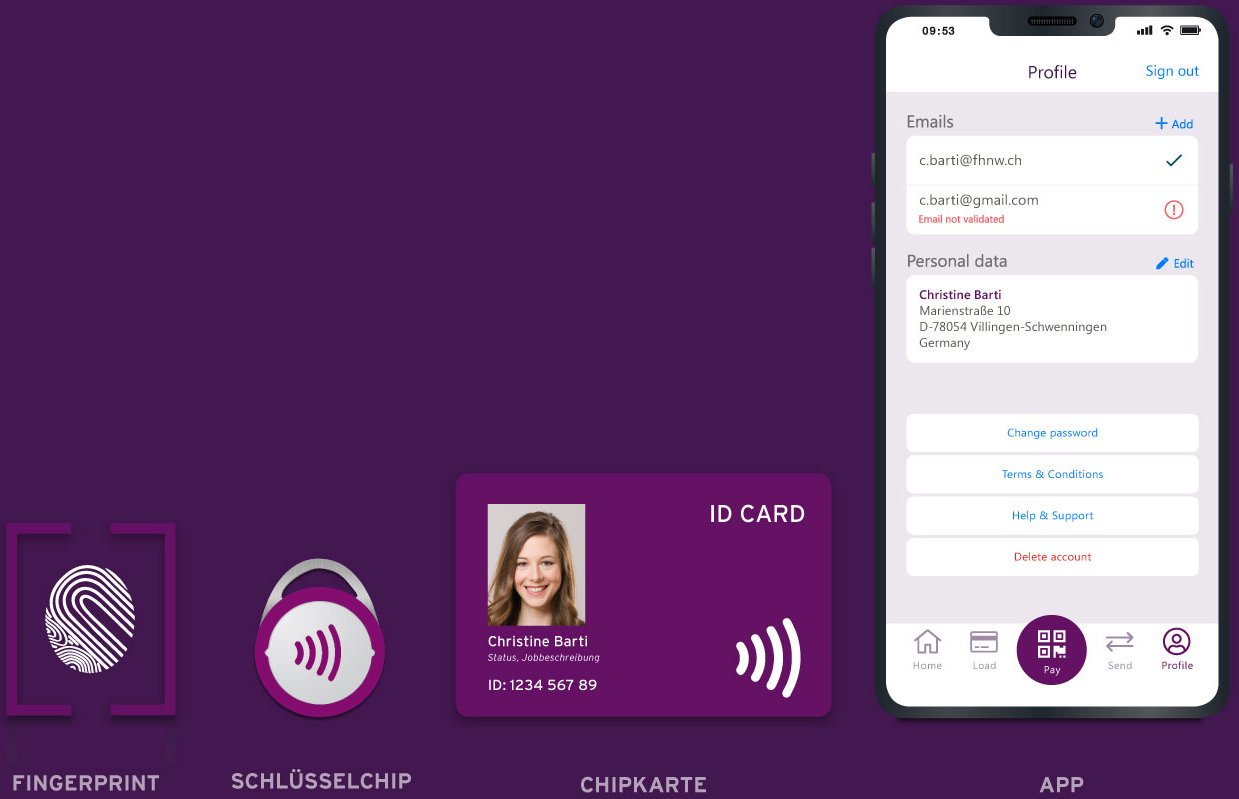

Chipkarte oder App erstellen und sofort das ganze System nutzen

Erstellen Sie für jeden Nutzer eine persönliche App oder Chipkarte, mit der sich Ihr Nutzer überall im SECANDA System identifizieren kann – zum Bezahlen, für den Zutritt zu Räumen oder Daten oder um Schließfächer zu mieten.

EINE ZENTRALE ID FÜR ALLE LÖSUNGEN

Mit derselben ID an allen Terminals abrechnen oder bezahlen

Für die bargeldlose Bezahlung im Shop, in der Kantine oder Mensa, am Drucker, an der Fahrradgarage oder am Schließfach und an jeder anderen Bezahlstelle identifizieren sich die Nutzer mit derselben ID und Chipkarte.

Vom Guthabenkonto bezahlen oder Kostenstellen zuordnen

Zahlbeträge werden entweder gebührenfrei vom persönlichen Guthabenkonto abgebucht oder über die persönliche ID definierten Kostenstellen zugeordnet. In jedem Fall bezahlen Sie mit derselben im System hinterlegten ID.

Türen öffnen, Daten abrufen oder Schließfächer mieten

Mit derselben ID oder Chipkarte erhalten Ihre Nutzer auch individuelle Rechte zum Öffnen von Türen oder Abrufen von Daten. Sie nutzen Schließfächer, erfassen Zeiten oder mieten Räume und Fahrradgaragen.

Freie Wahl des Mediums für Identifikation

Jeder Nutzer benötigt für alle Anwendungen nur noch eine einzige zentral angelegte ID – verlinkt mit seiner Chipkarte oder dem Schlüsselchip und seiner App sowie seinem neuen persönlichen Guthabenkonto, um sich überall zu identifizieren, zu bezahlen und jederzeit den Überblick über alle Transaktionen zu behalten.

Freie Wahl des Mediums für Identifikation

Jeder Nutzer benötigt für alle Anwendungen nur noch eine einzige zentral angelegte ID – verlinkt mit seiner Chipkarte oder dem Schlüsselchip und seiner App sowie seinem neuen persönlichen Guthabenkonto, um sich überall zu identifizieren, zu bezahlen und jederzeit den Überblick über alle Transaktionen zu behalten.

Sichere ID und Schutz aller Daten

Jede ID steht sicher und eindeutig für eine Person. Deshalb erhält die ID im SECANDA System einen besonderen Schutz. Niemand kann die ID einer anderen Person unberechtigt nutzen oder auf sensible Daten zugreifen. Auch Bewegungsprofile lassen sich nicht durch Fremde auswerten und Datenschutz wird festgelegt: gelöscht heißt gelöscht.

Sichere ID und Schutz aller Daten

Jede ID steht sicher und eindeutig für eine Person. Deshalb erhält die ID im SECANDA System einen besonderen Schutz. Niemand kann die ID einer anderen Person unberechtigt nutzen oder auf sensible Daten zugreifen. Auch Bewegungsprofile lassen sich nicht durch Fremde auswerten und Datenschutz wird festgelegt: gelöscht heißt gelöscht.

Offene Schnittstellen für vorhandene Systeme

Nutzen Sie die offenen Schnittstellen der SECANDA Software für Ihre bestehenden System-Komponenten oder setzen Sie auf unser SECANDA Gesamtsystem aus einer Hand.

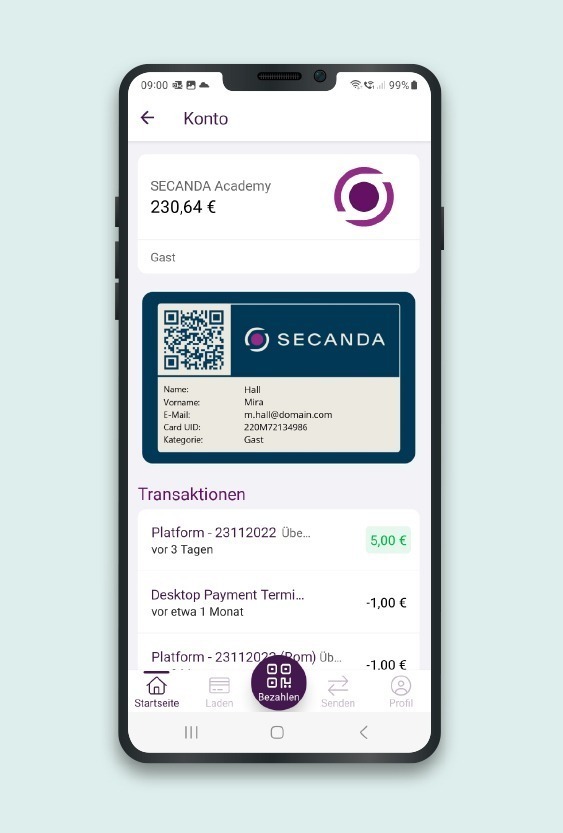

DAS GUTHABENKONTO

ZUR ID

DAS GUTHABENKONTO

ZUR ID

Alles vom gleichen Guthabenkonto bezahlen

Zu jeder ID wird ein Guthabenkonto geführt. Immer, wenn der Nutzer mit der persönlichen Chipkarte bezahlt, wird der Zahlbetrag direkt vom persönlichen Guthabenkonto abgebucht. Aufladevorgänge mit der Chipkarte am Automaten werden dem Guthabenkonto gutgeschrieben.

Wer darüber hinaus sein Guthabenkonto über Webbrowser oder SECANDA App verwalten und per Lastschrift oder Kreditkarte aufladen will, meldet sich im ersten Schritt zusätzlich am Online-Portal an und erstellt einen persönlichen Account.

App und Online-Portal

zum Guthabenkonto

1

Den persönlichen Account für Online-Portal und App selbst erstellen.

2

Den Account auf dem Online-Portal und der App mit dem persönlichen Guthabenkonto verlinken: Die Freigabe des Guthabenkontos erfolgt über die hinterlegte persönliche E-Mail-Adresse des Kontoeigentümers.

3

Jetzt kann der Inhaber des Accounts über das Online-Portal oder die App alle Transaktionen auf dem freigeschalteten Guthabenkonto einsehen, das Guthaben aufladen und Geld an andere Nutzer im gleichen Bezahlsystem transferieren. Dabei können Eltern sogar auf mehrere Konten ihrer Kinder zugreifen.

Das Guthabenkonto zu jeder Zeit online verwalten

Nutzer können ihr Guthabenkonto selbst verwalten und ihre persönlichen Daten jederzeit einsehen oder ändern. Der Kontostand wird immer angezeigt.

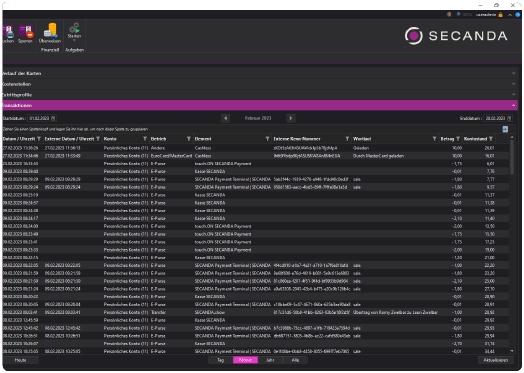

Alle Kontobewegungen wie Einkäufe, Überweisungen oder Aufladungen werden aufgelistet und der aktuelle Kontostand wird entsprechend angepasst.

Das Guthabenkonto kann per Lastschrift vom Bankkonto, mit Kreditkarte oder PayPal aufgeladen werden. Am Aufladeautomaten kann das Guthabenkonto zusätzlich mit Münzen und Banknoten aufgeladen werden.

Geld kann von einem Guthabenkonto auf jedes andere Guthabenkonto im gleichen Bezahlsystem eines Betreibers überwiesen werden.

Das Guthabenkonto aufladen

Online aufladen

Wer über das Online-Portal für das Online-Konto oder die SECANDA App angemeldet ist, kann das Guthabenkonto auch mit dem Smartphone aufladen. Der Aufladebetrag wird eingegeben, dem Guthabenkonto gutgeschrieben und automatisch vom hinterlegten Bankkonto, der Kreditkarte oder PayPal abgebucht.

Am Automaten aufladen

An den Aufladeautomaten lässt sich das Guthaben mit Banknoten, Münzen, mit der Kreditkarte oder der girocard aufladen. Der Nutzer identifiziert sich mit der Chipkarte am Automaten und der Aufladebetrag wird anschließend direkt auf dem Guthabenkonto gutgeschrieben. Bei Bedarf kann Guthaben auch am Automaten ausgezahlt werden.

VOM GUTHABENKONTO

BEZAHLEN

VOM

GUTHABENKONTO

BEZAHLEN

Alles vom gleichen Guthabenkonto bezahlen

Ihre Nutzer können überall im System mit der gleichen Chipkarte vom gleichen Guthabenkonto bezahlen. Egal, ob sie an der Kasse, am Getränkeautomaten, am Drehkreuz in der Kantine, am Drucker und Kopierer oder am Schließfach bezahlen: Immer wird der Zahlbetrag vom selben Guthabenkonto abgebucht.

Kostenfreie Transaktionen und volle Transparenz

Durch das eigene zentrale Guthabenkonto bleiben Betreiber und Nutzer des SECANDA Systems unabhängig von externen Payment-Dienstleistern und Banken. Das Guthaben kann nicht nur bar eingezahlt, sondern auch vollkommen gebührenfrei genutzt werden. Transaktionen bleiben kostenfrei, können von Dritten nicht ausgewertet werden, Nutzerprofile werden nicht erfasst und trotzdem sind alle Vorgänge für jeden Nutzer transparent einsehbar.

Guthaben managen und Kostenstellen zuordnen

Nicht nur mit dem Guthaben kann bezahlt werden. Auch individuell einstellbare Limits zum Bezahlen ohne Guthaben können gewährt werden. Ebenso können Zahlbeträge mit Kostenstellen verrechnet werden: Die Chipkarten lassen sich dabei mehreren Kostenstellen zuordnen, ebenso wie mehrere Chipkarten einer Kostenstelle.

DER MANAGER ZUM SECANDA GESAMTSYSTEM

Von einem Ort aus das ganze System managen

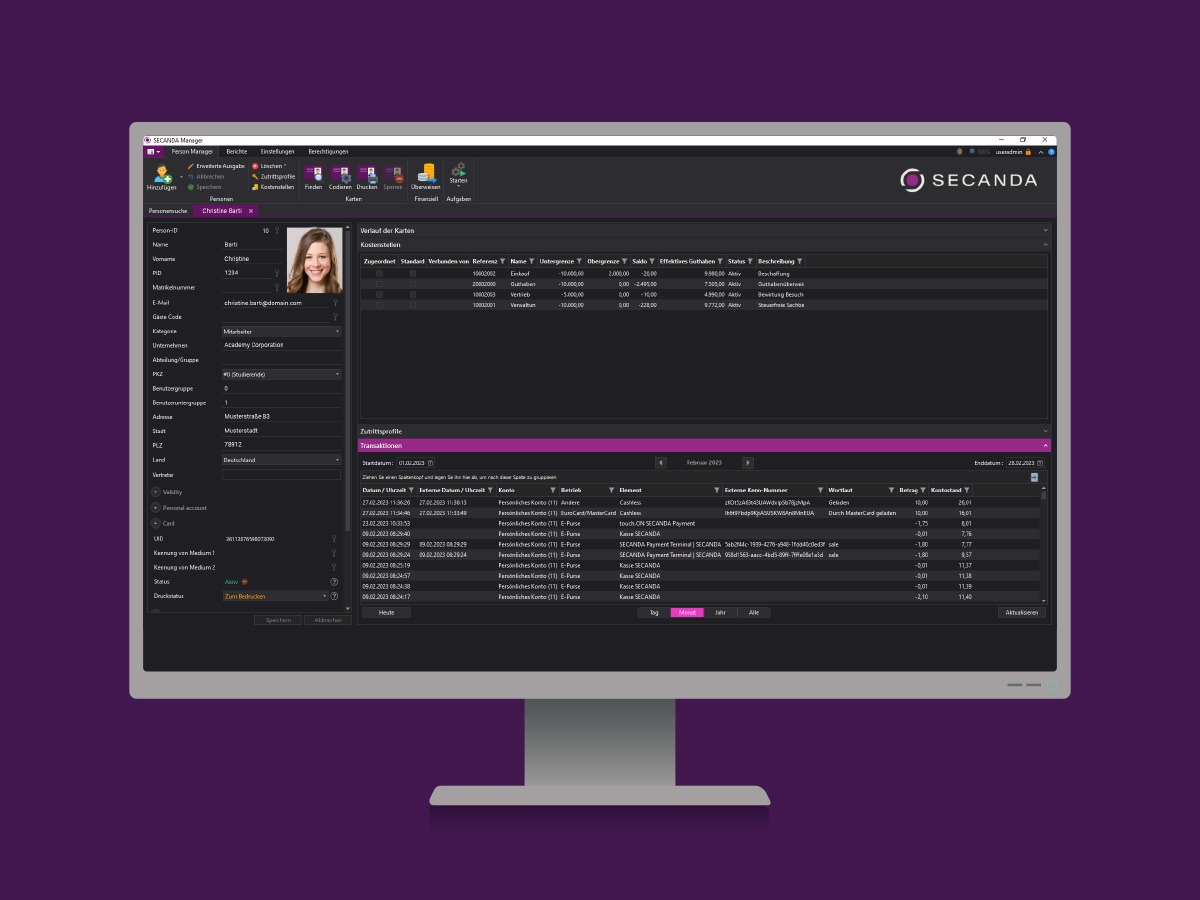

Einfache Administration und voller Überblick über das System

Als Administrator Ihres Systems haben Sie von einem Arbeitsplatz aus mit nur einer webbasierten Software die Kontrolle und den Überblick über Ihr ganzes SECANDA System.

Nutzen Sie die offenen Schnittstellen der Software für Ihre bestehenden System-Komponenten oder setzen Sie auf unser SECANDA Gesamtsystem aus einer Hand.

Sichere IDs anlegen und mit Rechten ausstatten

Neue Nutzer lassen sich mit der Software im Handumdrehen anlegen. Nutzerdaten müssen nur einmal zentral verwaltet und aktualisiert werden.

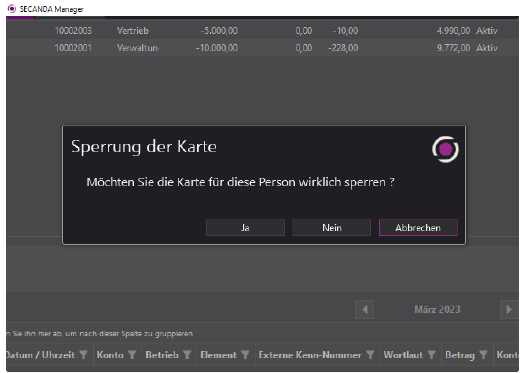

Das Guthabenkonto und alle Transaktionen im gesamten System sind einsehbar. Nutzungsrechte lassen sich individuell vergeben und entziehen. Sperrungen werden sofort aktiv.

Bezahlstellen analysieren und auswerten

Für jede Bezahlstelle und jedes Terminal lassen sich Auswertungen erstellen und das Nutzeraufkommen sowie die Umsätze analysieren: An allen Kassen, Getränkeautomaten, Bezahl-, Druck- oder Kopierterminals. Zentral und auf einen Blick. Zu jeder Zeit kann überwacht werden, welche Produkte und Leistungen in welchem Volumen konsumiert werden.

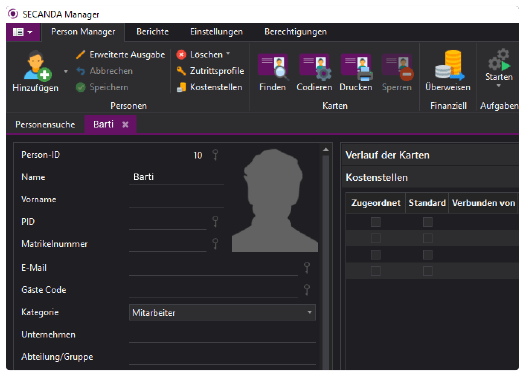

PERSONALISIERUNG FÜR NEUE NUTZER: DIE ZENTRALE ID ANLEGEN

NUTZER UND GUTHABENKONTO ANLEGEN UND VERWALTEN

Ein neuer Nutzer kann mit wenigen Klicks angelegt werden. Für die Bezahlung innerhalb des SECANDA Systems wird für jeden Nutzer automatisch ein persönliches Guthabenkonto eingerichtet.

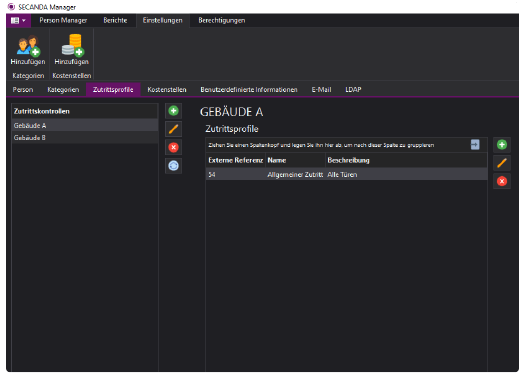

RECHTE ERTEILEN UND ENTZIEHEN

Zum Öffnen von Türen und Schranken, oder die Nutzung von Geräten und Räumen können individuelle Rechte erteilt oder entzogen werden.

CHIPKARTE KODIEREN UND DRUCKEN

Ist der Nutzer angelegt, kann seine persönliche Chipkarte ganz einfach erstellt werden. Die Chipkarte wird aus dem Identity Management mit den gewünschten Informationen wie Foto und Name bedruckt und gleichzeitig mit der ID kodiert. Die Chipkarte ist sofort einsetzbar.

CHIPKARTE & KONTO SOFORT SPERREN

Bei Chipkartenverlust oder nicht nachvollziehbaren Bewegungen auf dem Guthabenkonto kann der Administrator einzelne Karten oder das Konto sperren. Eine Karte kann jederzeit neu erstellt werden.

ZENTRALE VERWALTUNG: INDIVIDUELL FÜR JEDEN NUTZER

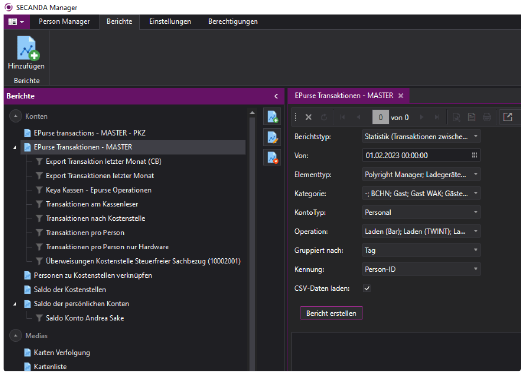

TRANSAKTIONEN EINSEHEN UND ÜBERPRÜFEN

Alle Transaktionen auf Guthabenkonten, Kostenstellen oder den angeschlossenen Geräten können eingesehen und nach verschiedenen Parametern gefiltert werden.

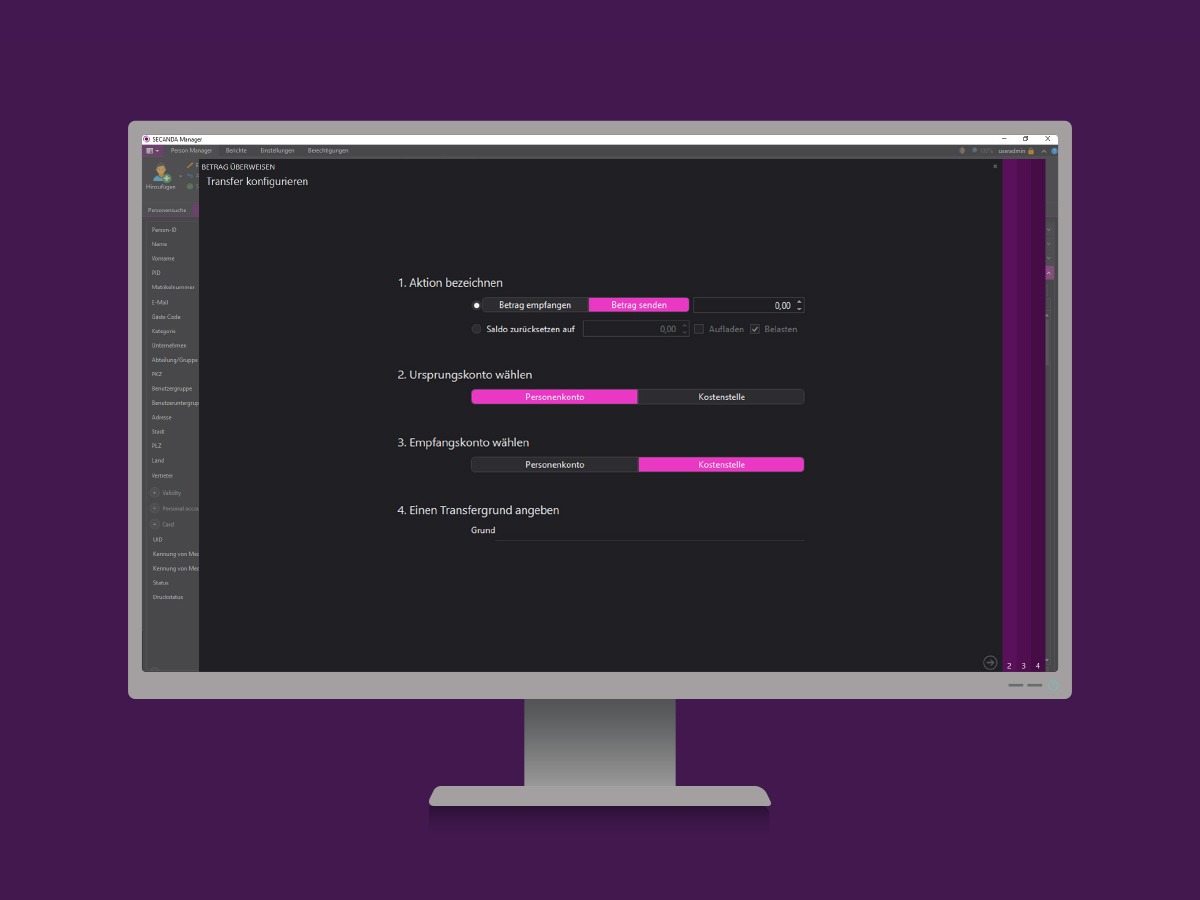

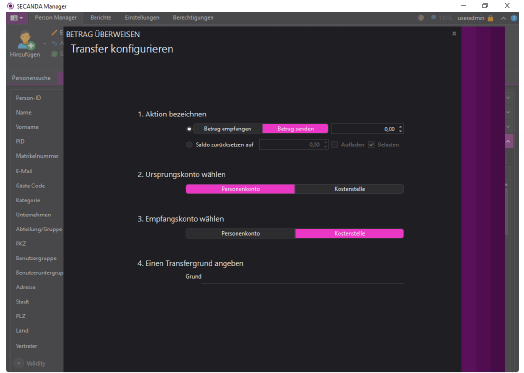

GELD TRANSFERIEREN UND KOSTENSTELLEN ZUORDNEN

An einzelne Nutzer kann innerhalb des SECANDA Systems Geld transferiert oder zurückerstattet werden. Nutzer können zudem Kostenstellen zugeordnet und mit einem Budget über Guthaben und Zeitraum ausgestattet werden.

BERICHTE, ÜBERSICHT, ANALYSEN

Nutzerdaten, Chipkarten, Bezahlvorgänge, Kostenstellen, Terminals oder Produkte sind für Administratoren jederzeit transparent und auswertbar. Für die Filterung und Berichte stehen verschiedene Parameter und Ausgabeformate bereit. Die Daten können in andere Systeme übernommen werden.

Optionale Erweiterungen zu Ihrem SECANDA System

Chipkartendrucker

Evolis Primacy

Chipkartendrucker Evolis Primacy

Der Evolis Primacy bietet hochwertigen Kartendruck für kleine und mittlere Kartenauflagen. Dank seiner neusten Technologie kann der Evolis Primacy hohe Geschwindigkeit mit hochqualitativem Druckergebnis verbinden. Beim Design des Druckers standen Komfort und einfache Handhabung im Fokus.

Der Evolis Primacy ist nicht nur außerordentlich platzsparend sondern auch leise (48 dB im Betrieb) und ökologisch: Er erhielt die offizielle Auszeichnung mit dem ENERGY STAR, welche besonders ressourcenschonenden Elektrogeräten verliehen wird.

Aufladeautomaten

in allen Varianten

Aufladeautomaten in allen Varianten

Passend zu Ihrem Identifikations- und Bezahlsystem steht für jede Anwendung der geeignete Automat zur Verfügung.

Um das Guthaben aufzuladen, müssen sich die Nutzer lediglich am Automaten mit der Chipkarte identifizieren. Das Guthaben kann dann entweder bar mit Münzen oder Banknoten, mit der girocard oder mit der Kreditkarte aufgeladen werden. Das Guthaben lässt sich am Automaten nicht nur aufladen, sondern je nach Ausstattung auch in Münzen oder Banknoten auszahlen.

Alle Automaten passen sich in der Ausstattung und den gewünschten Funktionen den Bedürfnissen an. Durch das webbasierte Interface können Updates oder zusätzliche Funktionen mühelos aufgespielt werden. Optional ist auch die Ausgabe und Rücknahme von nicht personalisierten Chipkarten möglich.

App-Bezahlterminal

für Shops

App-Bezahlterminal für Shops

Alternativ zum vollständigen Kassensystem mit Chipkartenleser kann jeder Shop auch ein Smartphone als Bezahlterminal einsetzen. Als App lässt sich die Anwendung problemlos auf jedem Android-Smartphone mit NFC-Schnittstelle installieren.

Bei der Bezahlung gibt der Shopbetreiber den Zahlbetrag in die SECANDA App ein und hält die Chipkarte des Kunden an das Smartphone. Der Betrag wird dann direkt vom Guthabenkonto abgebucht. Mit dem App-Bezahlterminal kann der Shopbetreiber auch das Guthabenkonto aufladen oder Teilbeträge ausbezahlen und ersetzt somit den Aufladeautomaten.

Ihre persönlichen Systemberaterinnen und -berater

Für jedes Thema und alle Regionen der richtige Kontakt. Wählen Sie bitte nach Bundesländern.

Wir freuen uns auf Ihre Anfragen.

Bitte wählen Sie hier Ihren Landkreis oder suchen Sie in der Karte Ihre Region.